Have any questions?

- Guntur +91 7997927111

- Vijayawada+91 9985858639

Offline

Tally with GST Training Course In Vijayawada

✓

✓

✓

Duration

60 Days

Rating

5

Total Students

1000+

Enquiry Now

Tally with GST Course Curriculum

- Introduction to Manual accounts

- Basic Accounting terminology

- Accounting Concepts

- Golden Rules of Accounts

- Personal Account

- Real Account

- Nominal Accounts

- Journal Entries

- Single entry Method of Accounting

- Double Entry Method of Accounting

- Creation of accounting Ledgers

- Preparation of Trial balance

- Generating Reports

- Trading account

- Profit and loss account

- Balance sheet Reports

- Creating The Company with security Features

- Selecting the company

- Altering the company

- Deleting the company

- Groups identification

- Ledger creation

- Single ledger

- Create

- Display

- Alter

- Introduction to Stock summary

- Stock summary with Go downs

- Trial balances

- Trading account

- Profit and loss account

- Balance sheet

- Cash book

- Sales register

- Purchase register

- Cash flow statement

- Funds flow statement

- Maintain Bill wise detail

- Bills receivabl

- Bills payable

- Interest calculations

- Interest payable

- Interest receivable

- Budget and controls with credit limit

- Scenario management

- Reversing journal

- Optional vouchers

- Consolidation of Balance Sheet Reports

- Point of sales

- Enable Cheque printing

- Set alter banking features

- Enable zero valued transaction

- Cost centers

- Cost centers Classes

- Inventory vouchers

- Purchase Order Process

- Sales Order Process

- Bill of material with Manufacturing process

- Maintain separate discount column in invoices

- Maintain Batch wise details

- Maintain manufacturing Date and Expiry Date

- Track Additional cost of purchases in Tally ERP9

- Actual and billed Qty

- Zero valued entries

- Job order process

- Job work in order

- Job work out order

- Job costing

- Track cost for stock item

- Cash flow statement

- funds flow statement

- Ratio analysis

- Aging analysis

- Movement Analysis

- Negative Stock

- Negative Reports

- Overdue receivables

- Overdue payables

- Backup data

- Restore data

- Apply Tally vault password to existing company

- Apply Tally vault to newly created company

- Maintain multiple mailing details for company and ledgers

- How to Create security Controls in Tally Erp9

- Security control with Users

- Security control with Users with Audit features

- What is Split company Data

- You Will be Export data into various formats

- How to Import data into one company to another

- What is Goods and Service Tax (GST)

- Understanding SGST, CGST & IGST

- Setting Up GST (Company Level, Ledger Level or Inventory Level)

- GST Slab Rates For Regular and composite dealers

- E-Way Bill

- GST for COMPOSITE Dealers

- Creating GST Masters in Tally

- Intra-State Purchase transaction of GST (SGST + CGST)

- Inter-State Purchase transaction of GST (IGST)

- GST Purchases for Unregistered Dealers of India

- Reverse Charge Mechanism transaction of GST in Tally Erp9

- Intra-State Sales transaction of GST (SGST + CGST)

- Inter-State Sales transaction of GST (IGST)

- Printing GST Sales Invoice from Tally ERP9 Software

- Basic Concepts of TDS

- Configuring TDS in Tally Erp9

- Creation of TDS Masters

- Posting TDS Transaction in Tally Erp9

- TDS Payment Entry

- TDS Returns

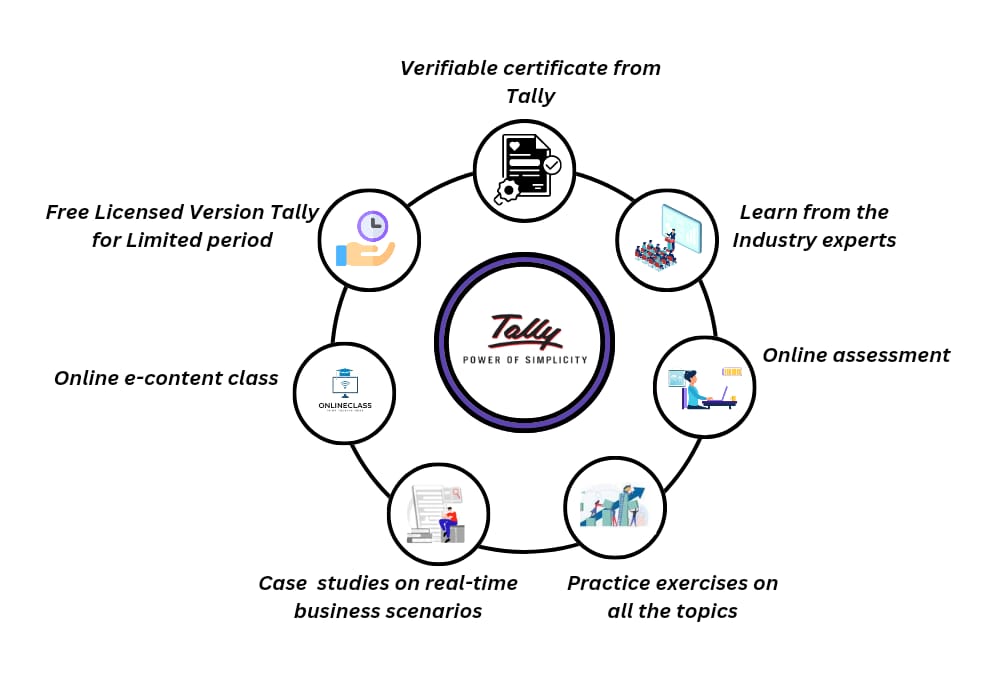

Tally with GST Course Key Features

Practice Labs For Real-Time Learning

Practice Labs makes it easy for you to put your learning into practice in a safe environment that you can access anytime with a compatible PC, Browser and Internet connection.

Live Project Training

We offer Live Projects and opportunity to take part in project design supported by industry partners including business and community organizations.

Classroom Training

We will use collaborative web conferencing with screen sharing to conduct highly interactive live online teaching sessions.

24/7 Support

Got queries? Our 24/7 support team will go extra mile so you can have easy and enjoyable experience with Nipuna Technologies on Slack which is a communication platform.

Job & Interview Assistance

Our interview assistance can help you overcome your fears and walk into your next interview with confidence and get your dream Job.

Internship After Course

Industry needs the best talent to stay afloat and thrive in today’s fast and ever-changing world, you will get a chance to do Internships and working closely that can provide a serious winwin for both Industry and students/trainees

Accounting Clerk

Accounting Associate

Accounts Assistant

Accounts Executive

Accounts Officer

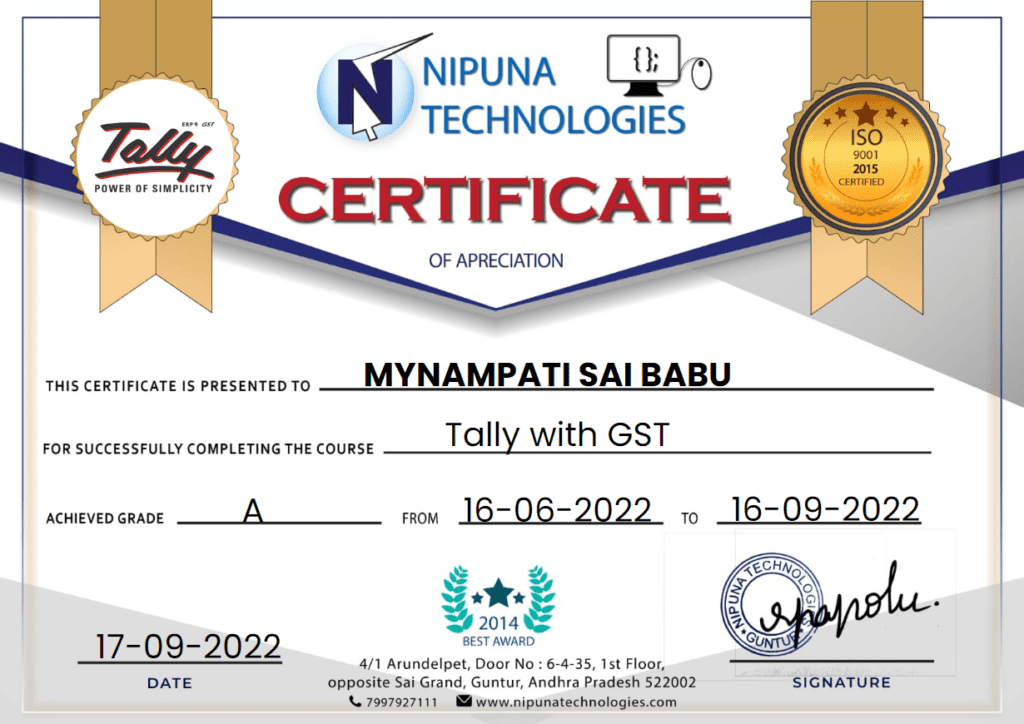

Tally ERP with GST Course Completion Certifications

Our training is based on the latest cutting-edge infrastructure and technology, ensuring you are fully industry-ready. Nipuna Technologies will present this certificate to students or employee trainees upon successful completion of the Tally ERP with GST Course, which will enhance and strengthen their resumes, helping them explore numerous career opportunities in the fields of Accounting, Taxation, and Financial Management.

Student Reviews

Hear what our students have to say about their learning experience with Nipuna Technologies.

Praveen Kumar

I joined this institute to take training for python fullstack Trainer knowledge is excellent and with this course I got ...

Read More

Nagasai Krishna

I have Enquired Python Training In Guntur, I Found Nipuna Technologies is The Best Python Training institute in Guntur....

Read More

Supriya

Nice teaching,lab facilities are good. Thank u nipuna technologies and kaif sir for teaching me tally course and ms offi...

Read More

Sunil Kumar

The instructors are competent, and I was able to enrol in both the Java and C programmes simultaneously, but what I real...

Read More

Anudeep Ande

Had a good learning experience. Joined with zero prior knowledge of tally but kaif sir made it very easy with detailed t...

Read More

Majeti Priya

I recently joined Nipuna Technologies for their AWS and DevOps course, and it has been an exceptional experience, largel...

Read More

Vishnupriya

Nice teaching,lab facilities are good. Thank u nipuna technologies and kaif sir for teaching me tally course and ms offi...

Read More

Tally with GST Training - Frequently Asked Questions

Students must have completed secondary education, i.e. 10+2 or equivalent (preferably in Commerce stream)

Basic knowledge of Business Management and Accounting has added an advantage to the Tally course.

Students can also learn the course after they finish their graduation. This Tally course will act as a professional boost if you are planning to get a job in the field of Accounting.

Tally software is an ideal solution for complete accounting, taxation, payroll, and monetary transactions recording. It’s being used by many business organizations to maintain their books of accounts. It also helps in record-keeping the business accounts very clear within the departments, which brings efficiency in transactions, task completion and reduces paperwork. By using Tally, you can avoid auditing errors and costly accounting. Because of its flexibility, it’s a choice of over 1 million businesses, including MNCs!

Learn the basics and Classification of Accounting.

Goods and Services Tax.

Company Formation.

Balance Sheet.

Ledgers.

Printing of Cheque.

Learn the Methods of Bank Reconciliation.

About Credit Limit.

Learn the rules of Taxation.

TDS and its Calculation.

Learn about Synchronization of Data.

Learn about Cost Centers and Cost Categories.

Learn Stock Analysis and Transfer.

Understand and Learn the GST Concepts.

Understand the Process of Sales and Purchased Order.

Learn about Contra, Journal, and Manufacturing Voucher.

The fees Structure of the course is the economical. However, please contact with us to obtain the discounted course fees.

We also provide courses like: DTP Course Vijayawada | Power BI Course Vijayawada | DevOps Course Vijayawada| Data Science Course Vijayawada| Autocad Civil Course Vijayawada| Python Full Stack Course Vijayawada

Absolutely! Our Tally with GST course is designed to cater to students with varying levels of accounting knowledge, including beginners. Our instructors start from the basics and gradually build up the complexity of the topics.

Upon successful completion of the course, you will receive a certification from Nipuna Technologies, which is recognized in the industry and can boost your job prospects.